Managed Futures are professionally managed investment portfolios that allow investors to simultaneously participate in multiple global market sectors such as foreign exchange, energies, metals, interest rates, equity indices and commodities. These investment programs are run by professional money managers, or Commodity Trading Advisors (CTAs), who use established portfolio and risk management techniques to manage their global portfolios.

How can Managed Futures help my investment portfolio?

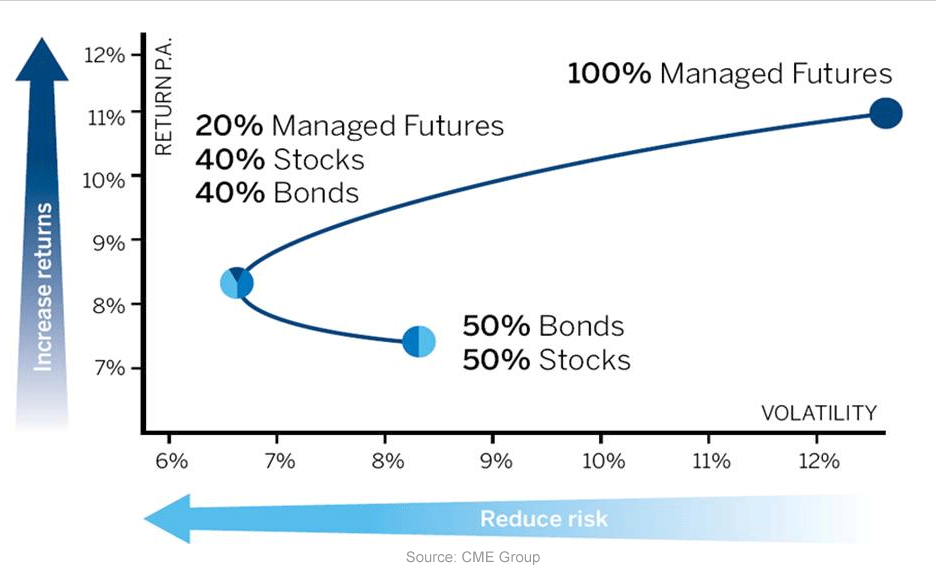

A key benefit of managed futures programs is their low correlation to traditional equity and bond investments. This is important because well constructed portfolios consist of investments or asset classes that do not move in tandem with each other and are uncorrelated to each other. Low correlated investments are expected to perform independently of traditional investments under the same economic events and market forces.

Our products and services enable clients to gain exposure to international investments and non-financial sectors on over 100 futures, foreign exchange and forward contracts worldwide. As a result, managed futures can provide a natural source of diversification to a traditional investment portfolio of equities and bonds.

Who Invests in Managed Futures?

Institutional investors have invested in managed futures since the mid-1980s. Since then, assets under management in managed futures programs have grown to $200 Billion. Today, a wide range of investors utilize managed futures as a portfolio hedge, from retail and high-net worth to institutional investors.

| ASSET MANAGERS | INVESTORS |

|---|---|

| Public Pension Funds | Individual |

| Endowments | Family Offices |

| Foundations | Registered Investment Advisors |

| Funds of Funds |

| COMPANIES | GOVERNMENTS |

|---|---|

| Corporate Treasury Dept. | Central Banks |

| Corporate Pension Fund | Sovereign Wealth Funds |

| Insurance Companies |