The key distinctions between managed futures and other alternative investment strategies include accessibility, a portfolio hedge, diversification, absolute returns, transparency, liquidity and variety.

Accessibility:

While hedge funds, private equity funds and venture capital investments are reserved for institutions and high net worth individuals due to high minimum capital commitments, CTA minimum account sizes can go as low as $25,000. With lower account minimums, managed futures are more accessible and practical for the average investor to add to their traditional portfolios.

Portfolio Hedge:

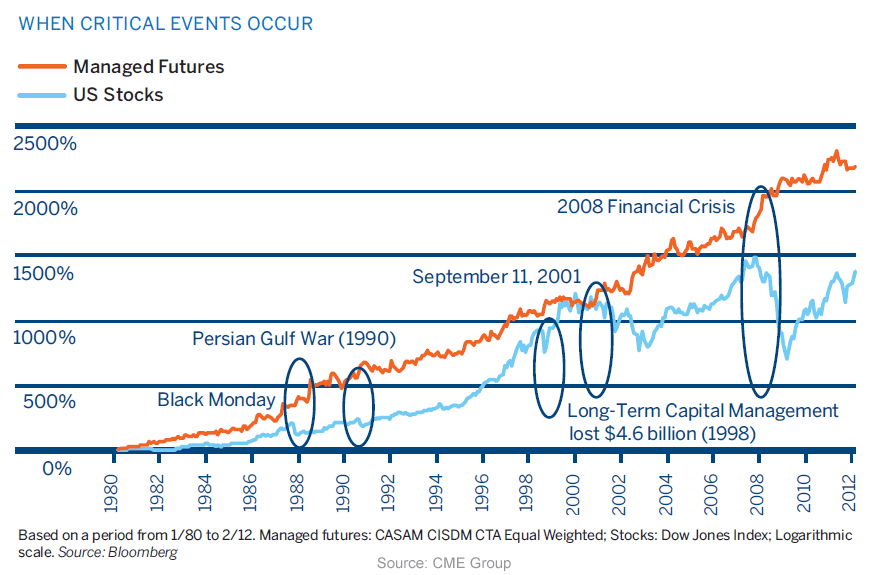

With low to negative correlation to traditional asset classes, including stocks and bonds, managed futures allow investors to hedge their portfolio against systematic market risk. This is a feature that proved to be important during the most recent financial crisis when stocks were down across the board – as well as most other alternatives – but the majority of managed futures programs produced solid, if not remarkable, returns.

Diversification:

The managed futures space provides investors access to the entire world of futures and options markets in multiple sectors. A sound Managed Futures portfolio is made up of a number of programs, giving the investor exposure to a diverse basket of commodities and strategies.

Absolute Return:

CTAs are able to profit from both up moves and down moves in a diversified group of markets and market sectors. This not only enhances a manger’s ability to profit, but to produce profits in periods where the rest of an investor’s portfolio is under stress.

Transparency:

As regulated entities, CTAs are required to report their performance on a monthly basis and track records and business processes are audited. Additionally, CTAs place trades directly into individual accounts and customers have full access to monitor all trades, calculate gains and losses, view open positions and account value on their daily statement.

Liquidity:

CTAs trade the most liquid, centrally-cleared and exchange-traded global commodity and financial futures markets. Customers also may rescind trading authority and withdraw funds from their account at any time. Unlike other alternative strategies, there are no lockout periods with a managed futures account.

Variety:

Because of the breadth of trading styles and strategies employed, investors can select a CTA or mix of CTAs that optimize return given their individual risk tolerance parameters to best compliment their traditional portfolio.